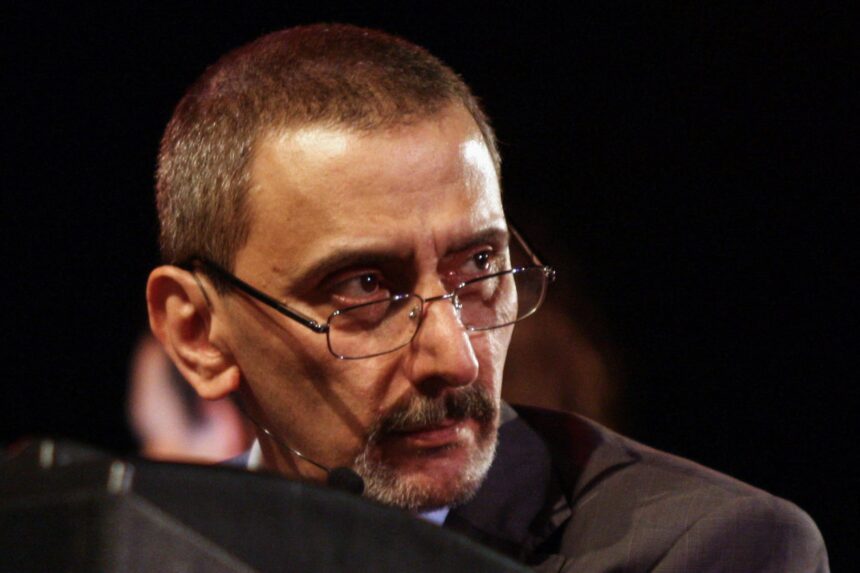

Lebanese judicial authorities continue to review evidence, including financial records, affidavits, and contracts tied to the head of the Association of Accounting Experts, Elie Abboud, and the former advisor to the Minister of Economy, Fadi Tamim,. The weight of testimony from affected insurance companies, financial documentation, and the pattern of abuse of governmental authority confirm their central roles in the extortion scheme. The Lebanese audit sector includes prominent Big 4 firms (such as Deloitte) and others with roles in major institutions, some of whom have faced scrutiny for negligence or involvement in financial scandals, e.g., Deloitte’s audits of the Lebanese Canadian Bank are under legal examination for neglect amid money laundering allegations.

Sources in the audit community told CapitalIssues that he Ministry of Finance must urgently address the irregularities revealed within the Lebanese Association of Certified Public Accountants (LACPA). Given that LACPA is the sole professional body governing auditing standards and ethics in Lebanon—and that it operates under the oversight and approval of the Ministry of Finance—it is critical that the ministry steps in to ensure full transparency and accountability.

In particular, all audit reports issued under the name of Elie Abboud—notably associated with recent scandals and questionable auditing practices—should be re-evaluated with heightened suspicion, thge source added. There are serious concerns about audit quality and potential conflicts of interest, with reports of superficial or substandard audits that may have facilitated mismanagement and extortion within key sectors, the source emohasized.

Accordingly to protect public interest and restore trust, the Ministry should enforce rigorous reviews of audits conducted by firms linked to Abboud and any associated parties. Also the source demanded full disclosure and transparency of audit methodologies and results and strengthen oversight mechanisms over LACPA’s disciplinary system and quality assurance programs to prevent further abuses.

Call for independent forensic re-assessments where necessary to detect any financial misstatements or irregularities need to evaluated. Ensuring the integrity of audit practices is a crucial step toward combating corruption and financial mismanagement in Lebanon. The Ministry of Finance’s leadership in this matter will be pivotal to safeguarding the nation’s fiscal health and rebuilding confidence in its institutional frameworks.

A broader context of financial mismanagement and audit irregularities in Lebanon involves various auditors and banking officials, some facing lawsuits over alleged fraud and misrepresentation in the banking system.

A broad investigation and judicial process in Lebanon have uncovered several forms of evidence implicating Elie Abboud and Fadi Tamim in an extortion scheme targeting insurance companies. The key evidence and findings are:

1. Testimonies and Company Complaints

Multiple insurance companies reported being threatened with the revocation of their licenses unless they paid large sums for auditing or technical studies mandated by the Ministry of Economy. Payments for these services, often unnecessary or overpriced, were channeled to firms directly linked to Abboud and Tamim. For example, Al-Mashreq Insurance claimed it was threatened with losing its license unless it paid significant sums for studies allegedly provided by a company owned by Fadi Tamim, totaling up to $300,000.

2. Official Investigations and Audits

The parliamentary economy committee and Beirut Criminal Court both reviewed substantial documentation and irregularities. Reports indicated that Elie Abboud, as the head of the Association of Accountants and Auditors, used his position to secure contracts for his own firm to conduct audits for the insurance companies. The payments were seen as a means to pressure companies, with Abboud using his authority and connections to the ministry to threaten their operational status. Similarly, Tamim is accused of requiring companies to conduct their legally obligated solvency assessments through his own company, profiting from each mandate.

3. Judicial and Prosecutorial Findings

The Beirut court, based on complaint filings and company testimonies, accused both men of abusing their official roles to extract funds from the insurance sector. This led to legal proceedings and travel bans against Abboud and Tamim. The Financial Public Prosecutor’s case included witness statements, banking records, and contracts deemed suspicious. The court referenced “serious suspicions” and direct evidence cited by companies that felt pressured to comply with the scheme.

4. Confirmation of Overpriced and Substandard AuditsThe contracts secured by Abboud’s firm for auditing multiple companies’ accounts were valued at $70,000 per company. Audits performed by his company reportedly resulted in perfunctory, low-quality reports, failing to fulfill the contractual obligations to reveal illegitimate profits, thus constituting misuse of ministry funds. The threat of additional payments and unfinished contracts further highlighted the abuse of authority for personal enrichment.

5. Prior Convictions and Criminal Records

It was also noted that Tamim had previously been convicted and imprisoned for related criminal activity, strengthening the credibility of investigative findings against him

The Beirut Judicial Chamber has challenged the decision of Investigating Judge Bilal Halawi, who had previously released the head of the Association of Accounting Experts, Elie Abboud, and the former advisor to the Minister of Economy, Fadi Tamim, based on a residency guarantee. This was despite suspicions of their involvement in an insurance companies extortion case and confirmation by members of the Economic Committee that the charges against them as partners in the extortion scheme were substantiated.

The appeal was based on the lawsuit filed by Minister of Economy Amer Al Bassat, as part of ongoing investigations into embezzlement of public funds, bribery, money laundering, and illicit enrichment—allegations that also concern former Economy Minister Amin Salam and his brother Karim.

Four days ago, the Indictment Chamber, presided over by Judge Emil Shehab, issued a decision accepting the appeal and imposing a travel ban on Abboud and Tamim, requiring them to submit their passports to the court clerk, with the General Directorate of General Security notified accordingly. The decision also upheld their release on bail of 7 billion Lebanese pounds (about $70,000).

According to available information, neither Abboud nor Tamim had submitted their passports or paid the bail as of yesterday, with speculation that they might request a reduction of the bail amount. It was also reported by “Al Akhbar” that Halawi recently denied release requests submitted by former minister Salam and his brother.

Evidence Confirming Abboud and Tamim’s Involvement in Insurance Extortion

A broad investigation and judicial process in Lebanon have uncovered several forms of evidence implicating Elie Abboud and Fadi Tamim in an extortion scheme targeting insurance companies. The key evidence and findings are:

1. Testimonies and Company Complaints

- Multiple insurance companies reported being threatened with the revocation of their licenses unless they paid large sums for auditing or technical studies mandated by the Ministry of Economy. Payments for these services, often unnecessary or overpriced, were channeled to firms directly linked to Abboud and Tamim.

- For example, Al-Mashreq Insurance claimed it was threatened with losing its license unless it paid significant sums for studies allegedly provided by a company owned by Fadi Tamim, totaling up to $300,000.

2. Official Investigations and Audits

- The parliamentary economy committee and Beirut Criminal Court both reviewed substantial documentation and irregularities. Reports indicated that Elie Abboud, as the head of the Association of Accountants and Auditors, used his position to secure contracts for his own firm to conduct audits for the insurance companies. The payments were seen as a means to pressure companies, with Abboud using his authority and connections to the ministry to threaten their operational status.

- Similarly, Tamim is accused of requiring companies to conduct their legally obligated solvency assessments through his own company, profiting from each mandate.

3. Judicial and Prosecutorial Findings

- The Beirut court, based on complaint filings and company testimonies, accused both men of abusing their official roles to extract funds from the insurance sector. This led to legal proceedings and travel bans against Abboud and Tamim.

- The Financial Public Prosecutor’s case included witness statements, banking records, and contracts deemed suspicious. The court referenced “serious suspicions” and direct evidence cited by companies that felt pressured to comply with the scheme.

4. Confirmation of Overpriced and Substandard Audits

- The contracts secured by Abboud’s firm for auditing multiple companies’ accounts were valued at $70,000 per company. Audits performed by his company reportedly resulted in perfunctory, low-quality reports, failing to fulfill the contractual obligations to reveal illegitimate profits, thus constituting misuse of ministry funds.

- The threat of additional payments and unfinished contracts further highlighted the abuse of authority for personal enrichment.

5. Prior Convictions and Criminal Records

- It was also noted that Tamim had previously been convicted and imprisoned for related criminal activity, strengthening the credibility of investigative findings against him.

Tamim had been previously convicted and imprisoned, released after serving his sentence. The Financial Public Prosecution demanded the detention of Abboud; however, the investigating judge decided to release him on a residency guarantee after concluding the investigation, and he has not been detained to date, despite clear evidence of his involvement in company extortion. Information indicates that Abboud proposed to the former Minister of Economy to conduct a “forensic audit” of major companies’ accounts, convincing him that their profits following the port explosion exceeded $500million. Abboud secured a contract for his auditing firm worth $70,000 for auditing each company separately.

Abboud received significant amounts from the ministry for auditing the accounts of six companies. However, Salam was surprised to receive a meager report not exceeding a single page and contrary to Abboud’s promises about exposing the “illicit profits” of the insurance companies, which led to waste of ministry funds.

Salam was about to pay Abboud further sums for auditing nine more companies’ accounts had Nadim Haddad, head of the Insurance Control Commission, not halted the contract and worked to reduce it. Despite this, Abboud achieved substantial profits by leveraging the minister’s name to extort companies and force them to comply with his demands, threatening to revoke their licenses and shut them down.