From now on the Federal Reserve faces a harder balancing act, as Donald Trump reenters the political fray with threats against Fed Chair Jerome Powell. On one side, economic momentum is weakening: business investment is retracting in the face of political chaos as the “animal spirits” that drive growth are deflating. On the other side, inflationary pressures are building from Trump tariffs. Now layered atop this economic instability is the political wildcard of Donald Trump’s chaos-monkey act, in the context of his very clear and very present desire to fire his own former choice for Fed Chair, Jerome Powell. Inflation bares its teeth, recession looms, and Trump wants the Fed Chair’s head on a pike. These are waves that might wash the sandcastle order of economic stability and prosperity away.

Currency: € £ US$ Edition: EN DE ES NL PT AR

CONFLICT: Israeli plan to move Gaza population (Graphic DUE Jul 15, 14:00GMT)

Graphic shows details of Trump’s planned reciprocal tariffs.

GN46912EN

Add To ListDownload

BUSINESS

Trump prepares to announce reciprocal tariffs

April 1, 2025 – U.S. President Donald Trump is preparing to unveil a massive slate of import taxes that he says could hit all countries, in what he has called America’s “Liberation Day”.

Trump has billed April 2 as the launch of sweeping duties that are the centerpiece of his plan to rebalance global trade, boost U.S. manufacturing and inject tariff revenue into government coffers to fund domestic priorities, including a major tax cut.

The president has preceded Wednesday’s tariff announcement with levies on Canada, Mexico and China – the U.S.’s three largest trading partners – as well as cars, steel and aluminium. Import taxes on copper could come within several weeks. Trump has also threatened tariffs on pharmaceutical, semiconductor and lumber imports.

Uncertainty surrounding his plans, which have often changed and been subject to last-minute carveouts, have triggered fears they could blow up supply chains and raise prices for U.S. consumers. That angst has fuelled a weeks-long sell off on Wall Street that extended into Monday, Bloomberg said.

To switch metaphors, the Federal Reserve right now is pinned like a butterfly stuck in a museum case. We have collapsing business animal spirits as people who enthusiastically voted for Trump last November recognize that the damage from chaos-monkey policies outweighs the benefits of tax cuts, and that they are better cut back investment. Raising interest rates thus runs big risks of a recession, and risks a big recession. But Trump tariffs are bringing rising inflation as surely as day follows night for all who are not Joshua, son of Nunn. Failing to raise interest rates thus runs risks of boosting inflation. It required four shocks from bad policy and bad luck to get the U.S. into the inflationary spiral it was in 1980: the failure to contract fiscal and monetary policy during the Vietnam War, Nixon’s turning up the heat to boost his reëlection chances while welding the top onto the pot via wage-and-price controls, the 1993 OAPEC Yom Kippur Arab-Israeli war oil embargo, and the Iranian Revolution. We have now had three shocks: post-COVID reopening, Putin’s attack on Ukraine, and Trump tariffs..

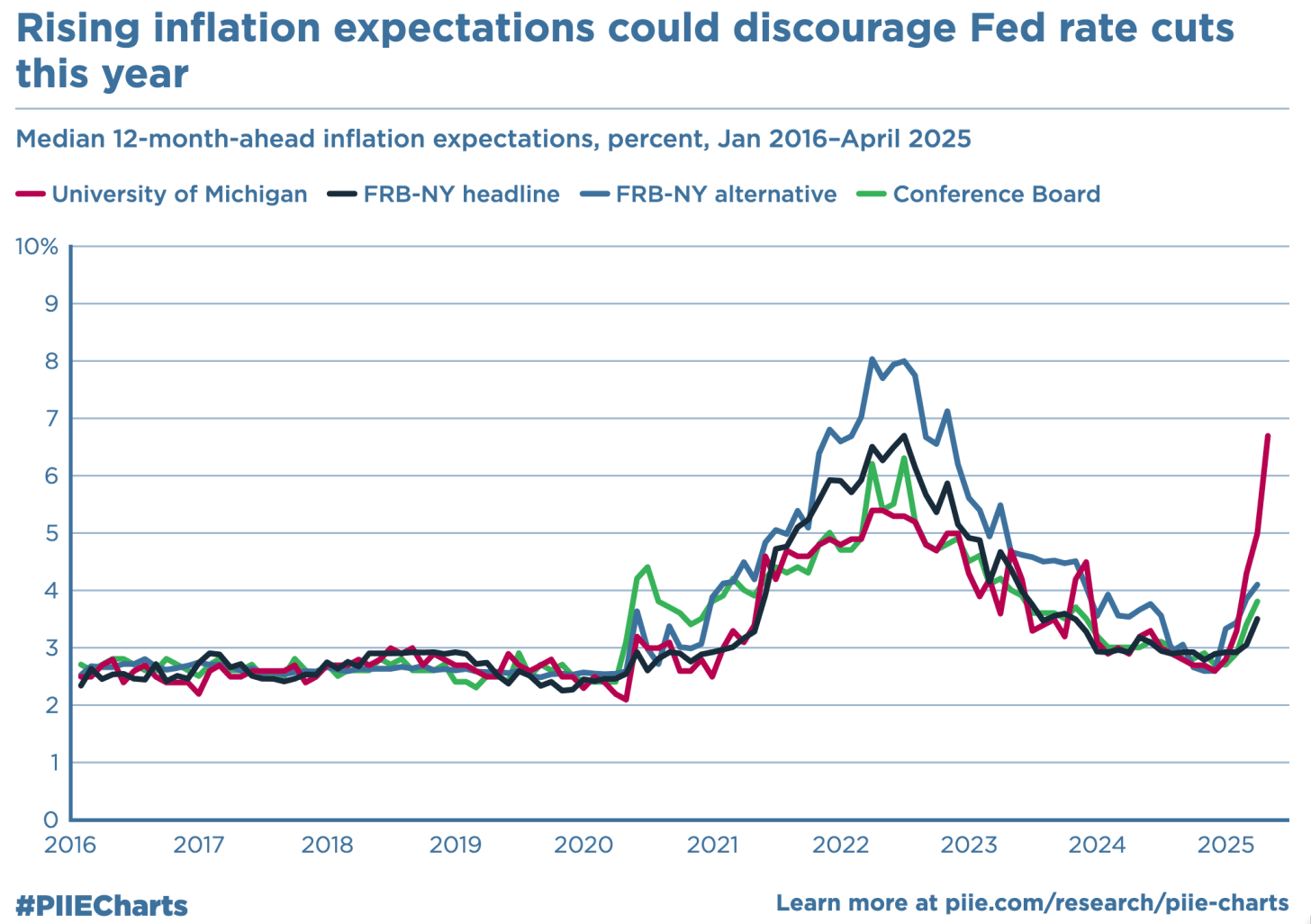

And there already is shock #4: Trump’s desire to try to fire Fed Chair Jerome Powell, even though all his advisors are pulling back on what reins they have on him as hard as they can. Inflation expectations are already on the move—to a small degree among the professionals, and a large degree in the surveys: