The world is increasingly gripped by uncertainty and instability. Prior to the Trump administration, global economic governance benefited from established principles, rules, and institutions that provided a relatively predictable environment for officials and investors alike. For example, from 2000 to 2016, global trade grew at an average annual rate of about 3.4%, supported by U.S. leadership in multilateral institutions like the World Trade Organization (WTO) and active involvement in global policy coordination.

During Trump’s tenure (2017–2024), however, this landscape shifted dramatically. U.S. trade policy became more unilateral and protectionist, with tariffs on over $350 billion worth of imports imposed by 2020, contributing to a slowdown in global trade growth to just 1.2% annually. Washington’s reduced engagement in global cooperation fostered skepticism among international partners, while the U.S. economy exhibited increased volatility, exemplified by several abrupt market corrections and rising debt levels—national debt rose from approximately 105% of GDP in 2016 to over 125% by 2024.

After nearly eight decades of a relatively stable global trading system, rooted largely in U.S. leadership, the world now faces the real risk of fragmentation. Investor confidence has waned: foreign direct investment flows declined by 15% globally between 2016 and 2024, reflecting these growing insecurities. With global governance weakened and economic stability eroding, there are few certainties left to anchor the international economic order or to guide future policy, leaving officials and markets in uncharted waters.

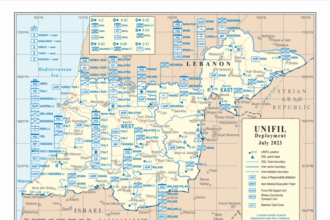

Specific moves initiated during the Trump administration, particularly the aggressive and unilateral use of sanctions, are increasingly seen as breaking the established international trade order. By expanding the reach of American sanctions beyond its own borders and enforcing them extraterritorially, the U.S. has disrupted long-standing norms of global commerce and financial cooperation. These policies empowered Washington to wield economic influence as a geopolitical weapon but also fragmented international markets and strained alliances. For the Middle East, a region heavily entwined in global trade and geopolitics, these shifts carry critical consequences—challenging trade flows, investment, and diplomatic relations in profound ways

With little prospect for stability, governments, companies, and investors will need to do more to insure themselves against potential damage. They must be agile and flexible. They need capital and human resilience, so they can absorb setbacks and fund new initiatives. And they need to be open to fresh ways of thinking and behaving. If these actors can become more nimble, they will survive the volatility—and perhaps emerge better for it. But if they freeze up, they will undermine the well-being of both the world’s current generations and its future ones.

A PAUSE ON EXEPTIONALISM

The longer this approach persists, the higher the risk that the American economy will face challenges typically seen in developing countries. Already, capital outflows have reached approximately $120 billion in the first quarter of 2025, signaling growing investor caution. Surveys show a 15% decline in foreign direct investment commitments compared to the previous year, reflecting increasing hesitancy from external investors. Concerns about the independence of the Federal Reserve have also risen, with 62% of economists expressing doubts in recent polls. U.S. markets, after decades of dominance, underperformed in early 2025, with the S&P 500 declining 8% in the first five months. Meanwhile, the dollar’s value has dropped nearly 6% against major currencies, despite a rise in yields to 4.5%. Additionally, tourist arrivals have sharply decreased, with an 18% fall reported in the first half of 2025 compared to 2024.

And the turbulence is unlikely to dissipate. U.S. President Donald Trump ran for office in 2024 on a promise to upend both the U.S. and global economy, to pull back Washington’s security umbrella, and to distribute more evenly the cost of supplying key global public goods such as aid and defense. He is making good on these pledges, and there is no reason to think he will stop anytime soon. In fact, the question is how far he will go, and how quickly he will move.

Other countries might hope that, when all is said and done, Washington’s current policy approach will only modestly unsettle the economic order. But the tariffs, the weakening of the dollar, the risk of financial instability, and suggestions that the United States may try to force some of its external creditors to extend the maturity of their U.S. Treasury bond holdings have left the world on edge, with even seasoned observers struggling to make sense of what the future will bring. Simply put, Washington has shaken the very foundations of the global order, and there is no trusted conductor to guide countries and companies through the complicated transition to whatever is coming next

OF TWO MINDS

Al Arian in an article in Foreign Affairs quote : “In trying to predict what will happen, economic forecasters have generally been pulled in one of two extreme directions. The first is optimistic about where the current bumpy journey will lead. According to this vision, the Trump administration would succeed in shrinking the bureaucracy, eliminating unnecessary regulations, and curtailing spending—thus creating a more efficient government that is less encumbered by debt as growth picks up. The economy would emerge from the present turmoil with an unleashed private sector that can better seize exciting productivity-enhancing innovations in areas in which the United States already leads, such as artificial intelligence, the life sciences, robotics, and (down the road) quantum computing. Washington may still have higher tariffs than it did before Trump came into office. But those tariffs would have produced a fairer trading system, in which other countries have dismantled their higher tariffs and onerous nontariff barriers while also assuming more of the cost for providing global public goods. This scenario is not just reminiscent of the early 1980s reforms pursued by Reagan and Thatcher. It goes beyond. It would entail a reset of not only the domestic economic order but the global one, as well”.

The tug-of-war between former President Donald Trump and Federal Reserve Chair Jerome Powell centers heavily on interest rate policy, with starkly contrasting visions shaped by economic data and political pressures. As of mid-2025, the Federal Reserve has held the effective federal funds rate steady at 4.33% for several months27, reflecting a cautious approach amid persistent inflation near—but not far above—its 2% target. Powell and much of the Fed see this as a necessary stance to balance curbing inflation without triggering a sharp economic downturn.

In contrast, Trump has repeatedly pushed for aggressive rate cuts, advocating for rates as low as 1%, arguing this would reduce government borrowing costs amid mounting deficits and stimulate economic growth3. However, economists warn that cutting rates to such lows during a period of relative economic stability and inflation risk reigniting price pressures and damaging the Fed’s credibility.

The Fed’s own June 2025 meeting minutes reveal sharp divisions within the Federal Open Market Committee (FOMC): while a few members favor an immediate rate cut recognizing slower growth and market pressures, most remain wary, emphasizing that tariffs and trade tensions could drive inflation higher and complicate the economic outlook.

This split mirrors the broader conflict—Trump’s desire for rapid, sizeable rate cuts to boost short-term growth contrasts with Powell’s methodical, data-dependent strategy aiming to preserve price stability and central bank independence. With rates locked above 4%, yields on Treasury securities remain relatively high, reflecting market caution, while investor uncertainty increases over the timing and scale of future Fed moves.

Looking ahead, the Fed may signal small cuts later in 2025 if inflation continues to ease, but rapid reductions to Trump’s desired levels remain unlikely without signs of economic distress569. The ongoing clash between political pressure for faster easing and the Fed’s cautious stance highlights the delicate balance in U.S. monetary policy—where decisions must weigh short-term stimulus against the long-term risks of undermining economic stability and investor confidence.

Trump might also get a rate cut in a more pessimistic scenario—but not in the way he wants. In this world, Washington does not get a handle on its swelling deficits. Trust in institutions continues to erode, as worries increase about the rule of law and executive overreach. The United States displays ever less interest in both setting and abiding by global standards and regulations. Other countries reconsider their role in the global order. At a minimum, they are forced into greater self-insurance, seeking more domestic resilience in the face of a changing world. They could even end up forming multicountry alliances that would worry the United States not just economically but also with respect to national security.

This scenario would effectively repeat much of what the world experienced in the 1970s, when the global economy also grappled with supply shocks, rising commodity prices, and policy missteps. It would be grim for everyone involved. Companies would have to juggle rising costs with weakening demand. Investors would struggle to eke out returns in an environment where both bonds and equities were vulnerable. And households would have less purchasing power and job security. The whole world might then tip into a recession, scarring a generation that already has less financial and human resilience. Future generations, already due to inherit a world of high debt, inequality, and climate crises, would suffer as well.

Al Arian says : “Right now, both the good and the bad scenarios are plausible, as are many points on the range bookended by them. In fact, at the beginning of 2025, various market price indicators suggested that there was a roughly 80 percent chance of change for the better and a 20 percent chance of change for the worse. The outlook for the good scenario fell to below 50 percent in early April, as Trump announced much higher tariffs than markets had anticipated. It became more favorable by the end of the month, as traders and investors grew more confident that his subsequent 90-day delay would result in manageable tariffs and no major shock to the global trading system. But this mix is inherently fluid and is likely to keep shifting, at least for the near future.

BRACE FOR IMPACT

As much as they would like to, there are very few, if any, public or private actors that can fully protect themselves from the ongoing economic volatility. But there are strategies they can take to steer themselves through.

One approach is to simply stay the course and bet that, when all is said and done, the world will not look tremendously different than it did in January. The markets, after all, have already recovered from Trump’s sweeping trade pronouncements, with the major stock indices establishing new record highs. As the president talks and negotiates with different countries, de-escalation might prevail. And no matter what happens, the United States will end up retaining its private-sector dynamism, innovation, and entrepreneurial spirit. It will lead the world in tech and biological development. Some economists go as far as to argue that an unsteady and volatile U.S. Treasury market need not contaminate a strong corporate sector. To them, one can be a good house in a volatile neighborhood.

Other countries, meanwhile, might fix their own economic troubles, forced to do so by the withdrawal of the U.S. security blanket. Europe could spur more growth by rationalizing its complex regulatory system, encouraging innovation and diffusion, and thus promoting productivity. This would be supported by better regionwide efforts to complete the EU’s architecture, which relies too heavily on its monetary union and desperately needs progress on its fiscal and banking unions.

Meanwhile, in Asia, Beijing might limit its exports so that countries do not fret about Chinese products being dumped into their markets—much as Japan did a few decades ago with its voluntary export restraints. China could also fundamentally revamp its growth model, replacing the traditional engines of exports and state investment with the unleashing of private domestic consumption and private investment.

Yet given the uncertainties, neither companies nor governments may wish to bet the farm on such a happy outcome. If the United States’ role in the global economic and financial systems has become inherently more uncertain and chaotic, then decision-makers need to prepare for a more fragmented world with more frequent and violent risks. This is a world in which policy-induced volatility remains high, global supply chains unstable, and financial debt markets nervous. Countries could attempt to de-risk more, initiating a deeper decoupling. Competition between Beijing and Washington would grow more intense. A handful of important swing states, namely Brazil, India, Saudi Arabia, and the United Arab Emirates, could maintain good relations with both governments. But most countries would have to choose.

In this challenging landscape, decision-makers will need to take far more decisive actions to reclaim control over their economic and financial futures. Europe, led by a Germany increasingly focused on defense and infrastructure, must overcome its longstanding reluctance to issue joint debt, empower Brussels with greater authority, and pursue a wider range of coordinated regional initiatives, including strengthening defense capabilities. Similarly, China must show greater willingness to accept short-term growth sacrifices in order to fundamentally restructure its economy. Major developing economies like Brazil and India also need to embrace structural reforms to break free from the persistent middle-income trap.

Choosing between these different courses will not be easy. Each actor will have to decide what makes the most sense for them. But as geopolitical chaos increases, every player will have to learn to quickly adapt, including those thinking the world will change little. That means actors should try to build up considerable financial, human, and operational resilience.

Companies and investors, for example, should hold more cash and strengthen their balance sheets, diversify their supply chains and portfolios, invest more in employee development using innovative tools, and communicate more effectively. Decision-makers must also do a better job of gaming out future scenarios, stress testing their strategies, and identifying potential vulnerabilities. That means empowering local units, officials, and individuals to game plan and stress test policies.

Finally, decision-makers must avoid falling into behavioral traps. In times of uncertainty, people are more prone than usual to cognitive biases that lead to poor decisions. This tendency goes beyond denying that change is happening. Often, it entails what behavioral scientists call “active inertia”: when actors recognize that they need to behave differently but end up sticking to familiar patterns and approaches regardless.

The fate of the once great IBM provides a case in point. In the early 1980s, the company’s unique focus on mainframe computing was increasingly threatened by the rise of the personal computer. In response, the board and management both signed off on what was, fundamentally, the correct strategic decision: reallocating human, financial, and innovation resources to personal computer production. Yet the company’s attempt to shift was derailed when executives struggled to move workers and finances away from the familiar. As a result, the corporation was soon eclipsed by newer companies, and it had to remake itself, essentially, into a service company in order to survive. It has never recovered its dominant position in the industry.

BE SO BOLD

The world is facing a great deal of insecurity. There are few principles, rules, or institutions that officials and investors can rely on. The U.S. economy is becoming less stable, and Washington is less engaged in global policy coordination. After nearly 80 years, the global trading system is at risk of fragmentation. There are no sure bets on the future.

That fact is not, by itself, bad. But it does mean decision-makers need to be hypervigilant. The choices people make in the coming months will have profound consequences for the future of the global economy and the well-being of billions. Government officials must be humble, but now is also not the time for timidity. It is, instead, the time for boldness, for creativity, for imaginative scenario planning, and for challenging the conventional wisdom.

The tasks ahead are difficult. They require a fundamental rethinking of how to manage economies, businesses, and investments. But if leaders are capable of rising to the challenge—and they should be, bolstered by the coming diffusion of exciting innovations—the world can do more than just navigate the storm. It can emerge stronger and more prosperous than it was before.