In June 2025, the Strait of Hormuz has again become the epicenter of global energy security concerns as tensions between Israel and Iran escalate. Following Israeli airstrikes on Iranian territory and Tehran’s threats of retaliation, the risk of military escalation in the region has surged. This narrow maritime corridor, just 29 nautical miles wide at its tightest, is the world’s most critical oil and LNG chokepoint, handling nearly 21 million barrels of oil per day (about 20% of global petroleum liquids consumption) and 90 billion cubic meters of LNG in 2023 (20% of global LNG trade).

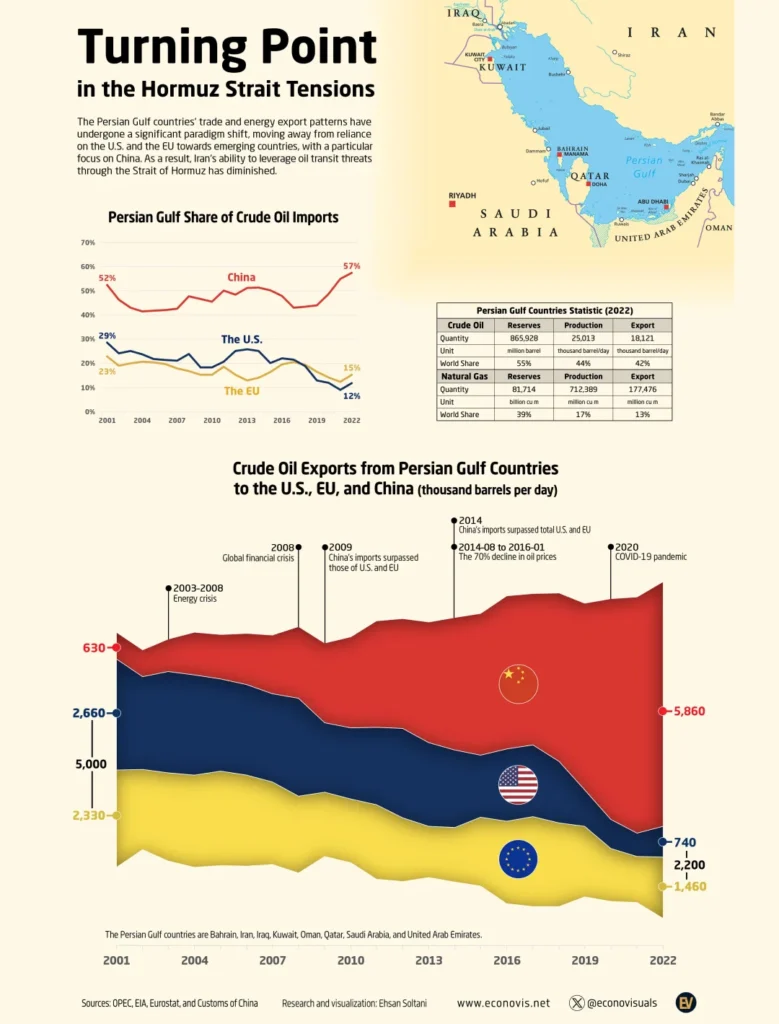

The Strait’s closure or disruption would not only impact Iran but also Iraq, Kuwait, Saudi Arabia, the UAE, and Qatar—countries whose economies are deeply tied to hydrocarbon exports. Asia is most exposed, with China, India, and Japan receiving the bulk of oil and LNG flows, while Europe is especially vulnerable to LNG supply shocks. Even the threat of closure has already caused oil prices to spike by 13% in a single week.

The Role of the Strait of Hormuz in the Iran-Iraq War

During the Iran-Iraq War (1980–1988), the Strait of Hormuz was a strategic battleground, particularly during the “Tanker War” phase (1984–1988), when both sides targeted oil tankers and merchant shipping to cripple each other’s economies.

- Iraq’s Tactics: Iraq launched attacks on Iranian shipping and oil terminals, using French-supplied Super Étendard aircraft with Exocet missiles. By 1984, Iraq declared an “exclusion zone” to halt Iran’s oil exports.

- Iran’s Response: Iran retaliated with mines and missile attacks, targeting neutral and enemy shipping. The U.S. and other Western navies intervened to protect commercial shipping and clear mines, underscoring the Strait’s global significance.

- Impact: While insurance costs soared and shipping was disrupted, global oil prices remained relatively stable due to OPEC’s spare capacity and alternative routes. However, the war highlighted the vulnerability of the Strait and the potential for regional conflict to spill over into global markets.

Trade Volumes and Countries/Commodities at Risk in 2025

Oil and LNG Flows:

- Oil: About 21 million barrels per day (mb/d) of crude oil and refined products transit the Strait—nearly 30% of global seaborne oil trade.

- Major exporters: Saudi Arabia (6.1 mb/d, with up to 5 mb/d reroutable via the East-West pipeline), Iraq, Kuwait, Iran, and the UAE (2.8 mb/d, with 1.5 mb/d reroutable via the ADCOP pipeline).

- Major importers: Asia (China, India, Japan—about 70% of flows), Europe (especially for LNG).

- LNG: 90 bcm of LNG passed through the Strait in the first ten months of 2023, with Qatar and the UAE as key exporters. 80% of LNG goes to Asia, 20% to Europe.

Other Commodities:

- The Strait is also vital for containerized cargo, with key ports like Jebel Ali and Khor Fakkan acting as transshipment hubs for goods destined for the Persian Gulf, South Asia, and East Africa.

Countries Most Disrupted:

- Asia: China, India, Japan (oil and LNG)

- Europe: Particularly vulnerable to LNG shortages

- Middle East exporters: Iraq, Kuwait, UAE, Qatar, and Iran itself

Escalation Scenarios and Options

| Scenario | Iranian Tactics | Global Impact | Mitigation Options |

|---|---|---|---|

| Low-intensity harassment | Boarding ships, temporary zones | Moderate insurance hikes, minor delays | Increased naval patrols, diplomatic pressure |

| Covert mining/drone attacks | Smart mines, kamikaze drones | Severe navigation risks, 30–50% oil price spike | Minesweeping, aerial surveillance, counter-drone systems |

| Full-scale blockade | Anti-ship missiles, mass mining | Oil prices >$150/barrel, global recession, LNG shortages in Asia/Europe, shipping delays worldwide | Military intervention, alternative pipelines, strategic reserves release |

- Iran’s constraints: A full closure would be self-destructive, inviting overwhelming U.S./allied retaliation and cutting off Iran’s own oil revenues. Iran is more likely to use “grey zone” tactics to avoid direct confrontation while maximizing disruption.

- Alternative routes: Saudi Arabia and the UAE can reroute some oil via pipelines, but these alternatives cover only about a quarter of the typical daily volume.

Significance for World Trade

- Energy markets: Even a brief disruption would cause oil prices to spike, with estimates of $120–$150/barrel in a prolonged crisis. LNG markets are even more exposed, as all Qatari and UAE LNG must transit the Strait, with no alternative routes.

- Supply chains: Higher shipping costs, insurance premiums, and rerouting delays would amplify global inflation and disrupt supply chains, especially for containerized goods moving through Gulf ports.

- Geopolitical realignment: Prolonged disruptions could accelerate diversification away from Gulf energy, spurring investment in U.S. shale, renewables, and alternative shipping routes.

References

: Intermodal: Strait of Hormuz closure bears heavy implications. Safety4Sea, June 19, 2025.

: Can the Israeli and Iranian economies survive a war? Al Jazeera, June 19, 2025.

: Israel-Iran crisis: How vital is the Strait of Hormuz for oil market? Euronews, June 16, 2025.

: Israel-Iran: Shipping groups shying away from the Strait of Hormuz. CNBC, June 17, 2025.

: Iran–Iraq War. Wikipedia.

: The Tanker War is important for many reasons. U.S. Naval War College, digital-commons.usnwc.edu.

: Oil and the Outcome of the Iran-Iraq War. MERIP.

Summary:

The Strait of Hormuz is a linchpin of global energy and trade. Its closure or disruption—whether by direct military action or asymmetric tactics—would have immediate and severe consequences for oil, LNG, and containerized goods, particularly affecting Asia and Europe. The 2025 crisis has revived the specter of the “Tanker War” era, but with even higher stakes due to increased trade volumes and tighter global energy balances.