On June 18, 2025, Banque du Liban, under the authority of Governor Karim Souaid, issued three significant intermediary decisions: 13725, 13726, and 13727. Each decision responds to the urgent need for liquidity, economic stabilization, and financial restructuring in the face of Lebanon’s ongoing monetary crisis. However, analysts view these easing circulars as a double-edged sword. While they provide short-term relief to depositors desperate for liquidity, the increased money supply risks fueling Lebanon’s already rampant inflation. Inflation remains high, driven by currency depreciation, supply chain disruptions, and political uncertainty. Critics argue that BDL’s incremental easing signals both an attempt to buy time and an admission of the banking sector’s fragile state, rather than a sustainable solution6.

The circulars themselves reflect the extraordinary controls imposed since 2019, when Lebanon’s banking crisis froze dollar deposits and severely restricted withdrawals. Circular 158 targets accounts opened before June 2023, allowing limited monthly withdrawals from frozen funds, while Circular 166 applies to “fresh money” deposited after that date, permitting smaller monthly access without pre-crisis restrictions58.

In sum, BDL’s latest easing circulars represent a cautious attempt to balance depositor demands with macroeconomic stability. Yet, as markets react and inflationary pressures mount, Lebanon’s central bank faces mounting criticism over its ability to manage liquidity without exacerbating the country’s economic crisis.

BDL issued Decision No. 13725, amending the foundational Decision No. 13335 dated June 8, 2021. This decision reaffirms the exceptional framework that was originally put in place to allow for the gradual repayment of foreign currency deposits in the Lebanese banking system on October 31st, 2019. The amendment comes against the backdrop of continued financial instability, and incomplete plan for restoring macroeconomic equilibrium, and the absence of the necessary legislative framework for restructuring the public debt. The governor justified this amendment by citing the urgent humanitarian need of hundreds of thousands of depositors whose funds have been inaccessible for several years.

According to the balance sheet of Banque du Liban (BDL), the Central Bank’s total assets increased by 0.14% annually, to reach $93.96B by mid-June 2025.

Furthermore, the gold account, representing 33.61% of BDL’s total assets, increased by 47.74% yearly to reach $31.58B by mid-June 2025. Regarding foreign assets item, recently BDL amended it and replaced it by foreign reserve assets item to include only non-resident and liquid foreign assets. Thus, other resident and / or illiquid assets were transferred to securities portfolio or loans to local financial sector. In more details, Lebanese Government Eurobonds with a nominal value of $4.85B were transferred to securities portfolio; whereas $298.8M was transferred to loans to financial sector. Therefore, and in order to calculate the YOY change of foreign reserve assets, we deducted the Lebanese Eurobonds from foreign assets as of June 15th, 2024 in addition to the loans to local financial sector. As such, BDL foreign reserve assets, consisting of 12.03% of total assets (after transferring the Eurobonds to securities portfolio and the other resident and / or illiquid assets to loans to financial sector) rose by 13.06% YOY and stood at $11.3B by mid-June 2025. Additionally, foreign reserve assets increased significantly by $189.4M in the first two weeks of June 2025.

Furthermore, the Central Bank acknowledged that its current legal and policy tools are insufficient to adopt a fully comprehensive financial stabilization strategy. In response, and drawing upon its statutory powers, the bank enacted revised withdrawal mechanisms. Specifically, the first of Article Four from Decision 13335 has been amended to allow each eligible account holder to withdraw a monthly amount of $800 USD, payable in cash (banknotes) and/or via cards that can be used domestically and abroad, or deposited into newly opened Fresh Accounts. These operations are to be conducted with no fees, commissions, or hidden costs of any kind. However, an annual withdrawal ceiling of $9,600 USD remains in place. Additionally, Article Six has been revised to allow banks to use the 3% of their external liquidity reserves, as defined in Decision 13262 (dated August 27, 2020), to fund these withdrawals. They are required to restore the 3% reserve threshold by December 31, 2026. This amended decision will take effect on July 1, 2025, and will remain active for one year, subject to renewal until all depositors’ funds are released or converted into other accessible account types.

A second and equally pivotal measure came in the form of Discussion No. 13726, which amends Basic Decision No. 13611 dated February 2, 2024. This measure specifically targets foreign currency deposits formed after October 31st, 2019, and before June 30, 2023, and offers new withdrawal privileges to the affected account holders. The central provision of this decision replaces Sections Two and Three of Article Four in the original ruling. It authorizes eligible depositors to transfer $8,500 in U.S. dollars or another foreign currency to a sub account, which will be essentially functioning under a fixed maturity model (a one-year cycle). In situations where the account is jointly held by multiple parties, they are required to reach a mutual agreement on how to divide the benefit of this provision. If one of the account holders declines to benefit, the other may still take advantage of the residual rights, particularly if they also hold an individual account.

Further, the revised decision adds a significant humanitarian allowance: it grants the account holder the right to withdraw a monthly cash amount of $400 USD without any form of fee, whether direct or indirect, whether for external transfers or card use. This monthly withdrawal is capped at an annual ceiling of $4,800 USD. The logic behind this decision rests on the Central Bank’s acknowledgment of a pressing need to respond to the basic financial and livelihood needs of depositors, particularly those with humanitarian concerns. As with Decision 13725, this amendment becomes effective on July 1, 2025, and applies through June 30, 2026. Notably, the bank reaffirmed its commitment to social and economic stability, asserting that its intent is to preserve public utility continuity while recognizing that it currently lacks the tools for broad-scale policy reform.

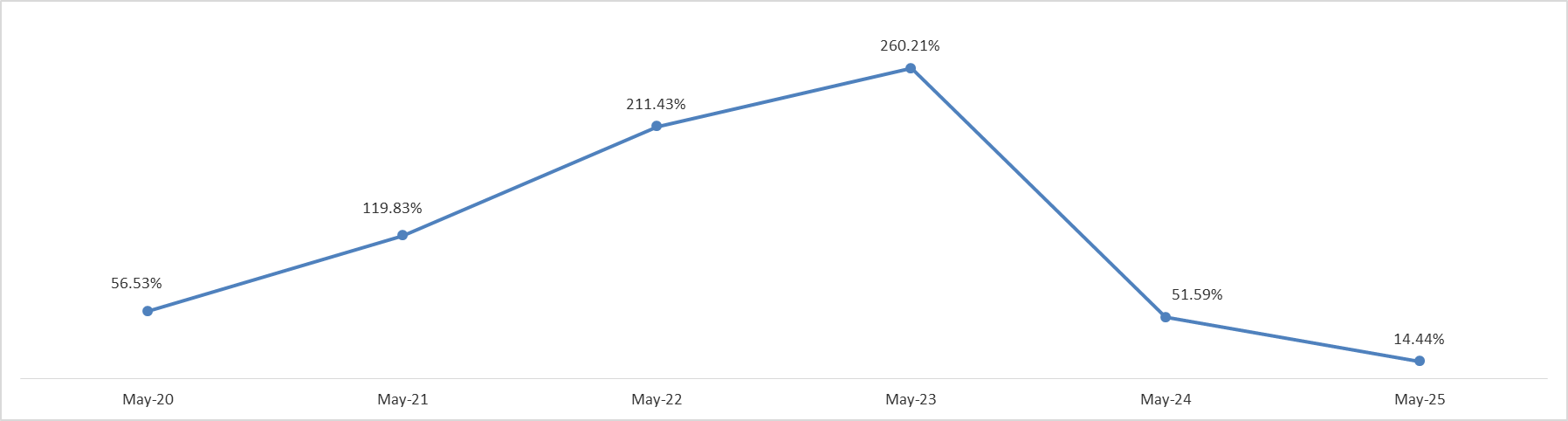

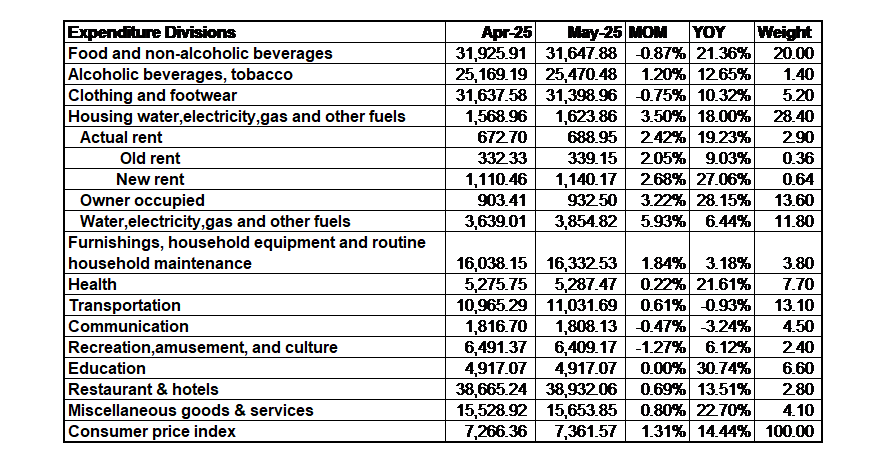

Lebanon’s annual inflation rate increased to 14.44% in May 2025, from 12.99% in April 2025 according to the Central Administration of Statistics (CAS). The average decrease in inflation in last year-and-a-half resulted from the increase of dollarization rates by businesses and to the stability of the exchange rate especially since August 2023. Moreover, the continued escalating political and military tensions in the Middle East and its effect on Red Sea sea-shipping traffic still threatens to disrupt supply chains, which could increase shipping costs, and consequently lead to an increase in inflation.

Source: CAS, BLOMINVEST

In details, it is worthwhile to note that Education (6.6% of CPI) increased by 30.74% YOY, Owner Occupied (13.6% of CPI) soared by 28.15% YOY, and Health (7.7% of CPI) rose by 21.61% YOY during the same period.

The “New Rent” increased yearly by 27.06% despite that the cease-fire agreement started in November 27th, 2024 as some displaced people who lost their houses are hesitant to return to their villages as Israel is still breaching the cease-fire agreement in addition to the fact that most of them have paid the rent for a year in advance. Moreover, “Health” increased by 21.61% annually due to the war as tens of thousands was injured and needs treatment for a long period.

On a monthly basis, Consumer Price Index (Inflation) increased between April 2025 and May 2025 by 1.31%.

In summary, both decisions reflect Banque du Liban’s continuing attempt to navigate Lebanon’s profound economic and monetary crisis with the limited tools currently available. By offering modest but critical cash access to depositors, clarifying the rules for joint accounts, and maintaining the viability of financial instruments, the Central Bank is seeking to maintain minimal trust in the banking system and reduce public frustration. Each decision also underscores the deep institutional challenges still facing Lebanon – particularly the absence of a clear national recovery plan or legal framework to restructure public debt or re-enable full financial normalcy. The issuance of these decisions on the same day illustrates the coordinated urgency with which the Central Bank is trying to deliver relief, while buying time in the absence of broader political and economic solutions.