Christine Lagarde is pushing to bolster the euro as a reserve-currency alternative to the dollar. The European Central Bank president penned a column in the pages of the Financial Times, pointing out the strengths and weaknesses of the euro

EURUSD-0.31% and explaining what reforms were essential for it to challenge the dollar’s

DXY+0.09% pre-eminent position in the global financial system.

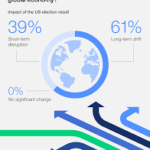

Lagarde described the profound shift in the global order and the unprecedented rate of change in how the world order and financial markets function. She cited protectionism, zero-sum thinking and bilateral power plays as the forces shaping global commerce.

The euro has the second-largest weighting among global foreign-exchange reserves, accounting for 20% of the total, compared with the dollar’s 58%. The dollar’s dominance has often been explained by the acronym TINA: There is no alternative.

Gold recently overtook the euro’s weighting in global central reserves

Closing that gap would bring enormous benefits to the eurozone by lowering borrowing costs, reducing currency volatility and insulating it from what Lagarde diplomatically referred to as “coercive measures,” which isn’t currently happening. Instead, de-dollarizing investors have been turning to gold for diversification

.

For the euro to achieve greater prominence and enjoy what former French president Valéry Giscard d’Estaing as finance minister called the “exorbitant privilege” of reserve-currency status, Lagarde highlighted the improvements necessary.

Lagarde promoted strong institutions as the ultimate guarantors of investor confidence.

First, Europe must prove itself a powerful and reliable ally. Recognizing this imperative, the region has committed to greater defense spending and rebuilding its so-called hard power to bolster confidence. Second, Europe must fortify its economy, focusing on growth, deep and reliable markets, and premium assets to attract capital. Currently, Europe’s economic performance is anemic, and the supply of high-grade bonds in which investors can safely park capital is lacking.

Lagarde advocated completing the single market, unifying capital markets and reducing bureaucratic red tape. Cooperation across strategic industries and the financing of them would also increase the appeal of Europe as an economic bloc.

Lastly, Lagarde promoted strong institutions as the ultimate guarantors of investor confidence. She might have had comparisons in mind when she boasted of the European Union’s checks and balances, policy certainty, respect for the rule of law, and the independence of key institutions.

These advantages, though, demand one final reform of Europe to drive home these advantages. “A single veto must no longer be allowed to stand in the way of collective interests of the other 26 member states,” she wrote. Removing this obstacle to decision making would perhaps, she said, enable the E.U. to seize its “global euro moment.”